- Why is all this necessary?

- What you did NOT know about proper waste sorting

- Overview of Free Software

- Bad habits fight

- Family budget planning

- Personal experience

- Alena, 33 years old, works in the IT field

- Rookie Mistakes

- Time to act

- Saving on electricity

- Account for all income and expenses

- Keep a list of future purchases

- Refrain from going to cafes and restaurants

- Less often take food in deliveries and takeaways

- Buy groceries and cook yourself

- Other

- Additional Tips

- Motivation to save

- Don't skimp on this

- Goal setting

- Eco life hacks for home and life

- Why, one small light bulb is on, it consumes little! Seriously?

- And the communal service will become cheaper, and you will help nature! How?

- I fried the fish and covered the stove! How to wash, if not chemistry?

- It's incredibly hot right now! Order not to buy water in the summer?

- Well, I can not do without the package! How do I put weekly purchases in a shopping bag?

- Share, don't buy

- Look for promotions, discounts and cashback

- Buy only what you need

- Cooperate with other people

- Conclusion

Why is all this necessary?

Here is a simple example: Saving only 500 rubles on a communal apartment. per month and channeling this money into accelerated mortgage repayment (for example, let's take a mortgage of 2.2 million rubles, for 15 years, at 11%), it will save:

on interest - 129,690 rubles. (although the accelerated repayment will be 170 months x 500 rubles = 85,000 rubles. And 44,600 rubles.will be earned by expedited returns!). Why 170 months and not 180? That's why…

in months - 170 months. vs 180 months = 10 months life! Due to the accelerated repayment of the mortgage, its term will be reduced by deeeeeeeeeahyyat months!!!

And saving on a communal apartment is just one microstep! And such steps, almost imperceptible for the usual way of life of the family, can be done dozens! Here is the great power of small steps! The one who neglects small amounts, thinking that it is "nonsense, incapable of something change", dooms himself to poverty in the present and / or future!

An even steeper effect is obtained over a long distance (10-15-20 years) when saving and investing these 500 rubles!

What you did NOT know about proper waste sorting

If you just started thinking about sorting garbage, then you should know that not everything is worth collecting and sorting, but only those raw materials whose type can be accurately determined (the number in the triangle on the package indicates the type of recycling). The container should always be clean, without food residues or fat on it. A free app can help you sort at the initial stage.

Okay, pick up the trash. Where to donate? All collection points for recycling and waste paper in our country are clearly demonstrated on (you can also read about the types of materials accepted for delivery). Points in Kyiv and the region can be looked at on the website.

Overview of Free Software

For the convenience of budgeting, financiers have developed programs that can be used to control their spending. Your attention is invited to several popular programs, downloading which on a computer, it is easy to control your money.

Programs used most often by users

- Zhadyuga.

- Home finance.

- Family budget.

- money tracker.

The proposed programs are free to download, so you can use the one that you like best.

A well-planned budget will help your family always remain financially prosperous. There will be no situation with a lack of money. Even a radical approach to spending is sometimes useful for the family, you can afford to buy what you could not previously.

Bad habits fight

Sooner or later, each of us has to think about how to manage the family budget as efficiently as possible. After all, this is an urgent need to avoid financial difficulties in the future. Even if it seems that you live well within your means, there will always be something that you can give up without difficulty, and sometimes even with benefit.

Review your bad habits. By giving up alcohol and cigarettes, you will save more than just money. Smoking is harmful to health, besides it hurts the wallet. Given that tobacco products regularly “grow up” in price, a bad habit costs a pretty penny. The same can be said about light alcohol. Calculate how much a daily bottle of beer costs, and then imagine what you can buy with this money if you put it off for a year.

Network games are considered by many to be harmless entertainment, a pleasant vacation, without thinking at all that this is a well-thought-out way of “pumping out” money. Without even realizing it, lovers of all kinds of "zombo farms" leave more than one thousand a year on the Internet. What can we say about avid gamers for whom the game is a competition.

Sugar is a food drug, which means that the habit of uncontrolled eating of “sweets” can be classified as harmful. The average family spends on confectionery from 200 to 1000 rubles a month.Ice cream, sweets, gingerbread, lemonade and other rubbish that cannot be called food or drink. Learning to live without sweets is not so easy, but such a victory will be all the more valuable. To understand which foods in the diet are superfluous, a detailed table of food costs will help.

Family budget planning

To properly plan a family budget, you do not need to have a special education. To do this, you need to identify the weaknesses of your budget, start accounting for expenses and eliminate rash purchases. Saving the family budget is impossible without controlling expenses and income. Without careful accounting, it is difficult to see where all the wages go. You can keep a family budget in a notebook or using applications, such as the popular Home Bookkeeping program.

In order not to make unnecessary purchases, you need to make a list of upcoming expenses. In addition to paying the loan, utility and other payments, paying taxes, the necessary purchases are made on the list, and the amount of expenses is calculated. At the end of the month, you need to check whether it was possible not to exceed the budget by making all the planned expenses. If expenses exceed income, some items will need to be reduced.

No one calls for resorting to total savings and denying yourself everything, however, you will have to give up excesses. It is necessary to focus on the necessary expenses and calculate them for a certain period of time (month or week). Then it is necessary to allocate a certain amount for force majeure situations (treatment, repairs, etc.), send the remaining money to the “reserve fund”.

For several months, you need to monitor expenses and, if possible, cut them. It is necessary to analyze the results obtained and draw up a clear budget.You need to try to gradually reduce costs by 1 - 5% per month. This method of saving is the easiest to use, as it changes the way of life and habits less. Some real tips for saving the family budget:

| Advice | Actions |

| Create an accurate family budget | Reducing costs is impossible without careful accounting. You need to calculate how much money you need to allocate for each of the items of expenditure and think about which of them can be eliminated or reduced. |

| Plan all expenses | If you plan all purchases in advance, you can eliminate unnecessary and useless purchases. When planning, you can consider the need for acquisitions and consider all options |

| Get the support of all family members | If one person in the family saves, and the rest do not, the correct distribution of the total budget will not be achieved. Therefore, it is necessary to consider the family spending plan with the whole family and come to a common opinion. |

| Avoid loans | Most often, purchases on credit involve an overpayment that increases the final cost of the goods. A person overpays and buys a thing that he can not afford. The exceptions are: buying a car, which can significantly increase income, or taking out a mortgage and making payments on it is cheaper than renting a house. In these cases, savings consist in choosing the most profitable option and, in addition, the funds are invested correctly. |

Personal experience

Alena, 33 years old, works in the IT field

I have been in the eco-theme for about five years. As a family, we have ditched plastic bags in favor of cloth shoppers, we carry reusable collapsible cups with us to coffee shops, and at home we use metal or bamboo straws.When traveling or for a picnic, we buy biodegradable tableware made of corn starch, it is sold on the Internet or at gas stations and is inexpensive: cutlery is about two hryvnias apiece, a salad bowl is up to 5 hryvnias, and a lunch box is 7-10 hryvnias.

I like to run, but I don't run marathons for environmental reasons: disposable cups, foil along the track after the race, stickers with numbers on jerseys. Popularization of marathons is good, but do not forget about the environmental side of this issue. For running and hiking, I got myself an Osprey Hydration Pack that fits in a backpack and is a reusable and convenient drinking system, no bottles! There is also, for example, water in edible algae capsules, which was successfully tested in the London Marathon. There is always a way out.

We sort the garbage as a family. Previously, we had sorting tanks under the house, but, alas, they are not everywhere in Kyiv. We recently moved and now we have no tanks, we have to take the garbage to the station. We go to Demeevka, one of the largest sorting stations in Kyiv, because they accept a lot of different raw materials for processing and you can come there with almost all types of garbage. My son is 4.5 years old, I always take him with me to the station and he already knows how to properly sort garbage. I think that sorting should be taught from childhood. Some stations conduct excursions for children and schoolchildren.

On the official website of the UN, there is something that each of us can start doing to save the planet: just lying on the couch, in our house, on the street and even in the office. We recommend reading.

Subscribe to us in , , Telegram.

Rookie Mistakes

There is a fine line between economy and greed.Many people, when managing the family budget, begin to infringe on their loved ones.

If you write down expenses in a notebook and see them, this does not mean that you should ban your husband from traditional football trips or stop giving money for your daughter's dance club. You can indulge yourself by ordering unhealthy but beloved pizza, or having dinner at a restaurant from time to time.

You don’t have to deny yourself a chocolate bar if you can’t live without sweets for the sake of saving 60 rubles, but you can stop buying water in stores. Better get yourself a beautiful bottle and take a drink with you from home.

Savings is one of the goals, you do not need to put it at the head of everything.

Time to act

Unfortunately, financial literacy is not taught in our schools and universities, so our citizens, being interested in how to save money in the family, draw advice from the Runet. According to state statistics, the salary of Russian citizens conquers minimums from year to year, it is not surprising that more and more people are asking:

- how to save in the family;

- simple ways to save money with a small salary;

- how to save a family with a housing scheme?

Then check out our tips, by the way, we previously wrote about where to look for working promotional codes for stores. Knowing how to save money in the family and optimize the personal budget, any of us can achieve excellent results. It's time to act!

Saving on electricity

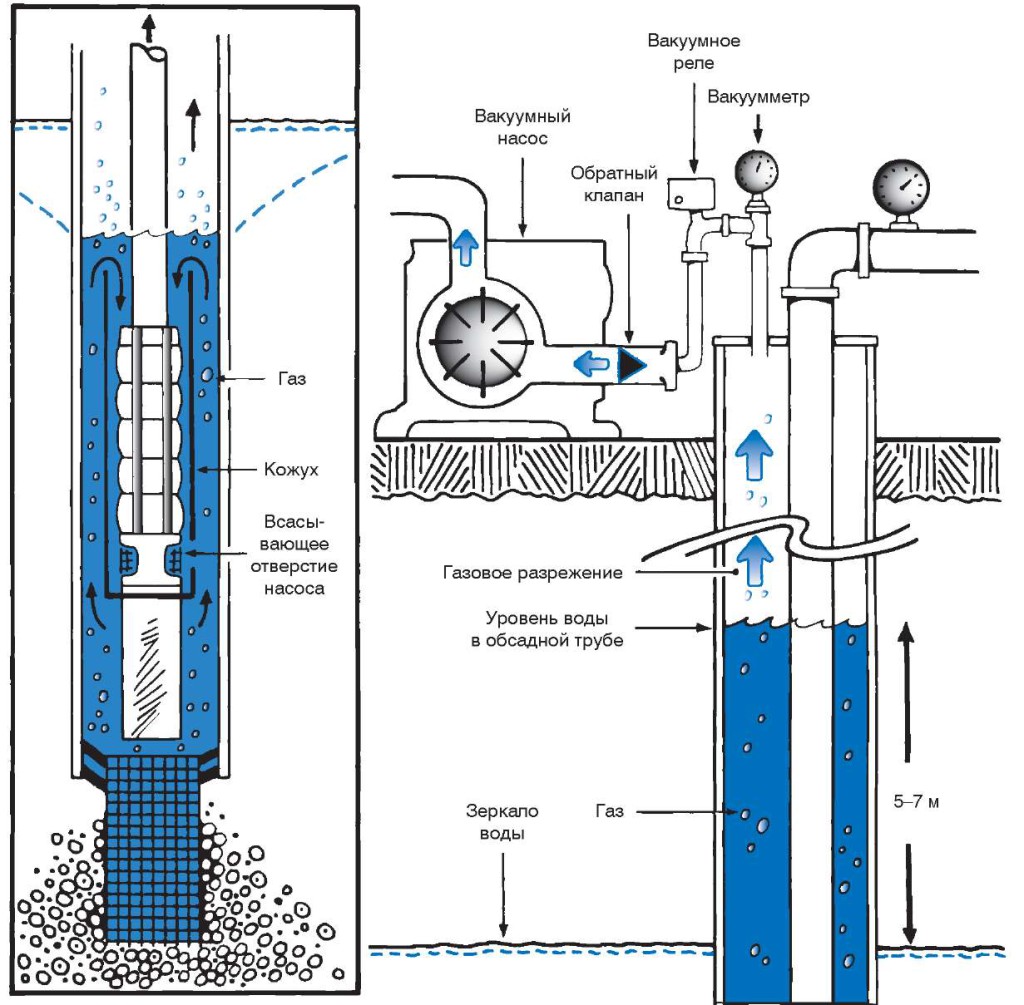

Counters. You can install a special meter that separates the day and night electricity consumption. Tariffs for nighttime electricity consumption are several times lower (in St. Petersburg, almost 2 times). In this case, washing and charging gadgets can be postponed until after 23:00 and pay less.

Pots and burners. Make sure that the diameter of the pan matches the burner of the electric stove: 50% of the electricity is wasted due to poor contact.

You can turn off the stove five minutes before the dish is ready. The dish will come to the residual heat.

Boiling water is cheaper on a gas stove than in an electric kettle. But if you still have an electric kettle, then you need to make sure that there is no scale in it (it increases the duration of heating), and it is better to boil as much water as necessary, and not fill the kettle every time.

Turn off the lights when you leave the room. For some reason I can't convince my wife to do this

Set the temperature on the boiler at 50-60 degrees. This will help reduce electricity consumption by 10-20%.

Energy-saving light bulbs are 50-80% more economical than conventional ones. Gradually change your light bulbs to LED bulbs - they not only use 90% less energy, but also last 10-20 times longer than conventional ones.

When you go on vacation, turn off all electrical appliances.

Install the refrigerator in a cool place. To prevent the refrigerator from consuming excess electricity, it should be installed away from batteries, direct sunlight, and at a distance of at least ten centimeters from the wall.

Motion sensors. In order not to forget to turn off unnecessary lights, you can install motion sensors.

Unplug all unused appliances after use. They still consume heat: toasters, TV, coffee machine, etc.

Turn off the dryer in the dishwasher. Dishes can dry out on their own.

Teach your kids to sleep at night without the lights on.

Don't leave your computer in "sleep" mode. Just turn it off after you use it.

Warm floor. Lay down a bath mat and you can lower the temperature of the underfloor heating or turn it off altogether.

Boiler size. Buy a boiler that is just the right size for your family – no more, no less. A large boiler will devour a large amount of energy for nothing.

Keep curtains closed during hot or sunny times of the day. This will help to significantly reduce the cost of air conditioning in hot season.

Load your washer and dishwasher at full capacity. This will help save water and electricity.

Washing and rinsing. Wash clothes in cold or warm water instead of hot. Rinse clothes in cold water.

Account for all income and expenses

We have already written about the principles and psychology of accumulation.

The main thing is to start taking into account all your income and expenses. You can do this "the old fashioned way" by drawing a notebook into several columns. But it is better to transfer the calculations to an electronic format.

By the way, if keeping a budget manually is troublesome for you, offers an overview of applications for tracking expenses. Such programs are installed on a smartphone and have a lot of useful functions - they import card transactions, generate monthly statistics and synchronize with a PC.

Keep a list of future purchases

In addition to strict budgeting, a shopping list helps save money. Psychology is at work here: sometimes it’s hard for us to refuse things that are on the counter - a silk blouse, branded sneakers or new smart watches. And if the desired product is at a big discount, then finding an argument against buying is doubly difficult.

To avoid such situations, start a shopping list or wishlist (from the English.wish list - wish list). Add there things that you really want to buy, and periodically review the positions. Now, when you spontaneously decide to spend money, the argument will work: this purchase is out of budget.

As experience shows, after a few days the excitement around the thing subsides. If this does not happen, feel free to add it to the wishlist. By the way, you can hint to friends and relatives about the purchase. So you will not spend your own money, and your loved ones will know what to give you for the next holiday.

Refrain from going to cafes and restaurants

This also includes coffee shops, bars, food courts, bakeries, culinary departments in hypermarkets. It’s amazing, but it’s food that hits the budget - coffee to go, a business lunch with colleagues, which has become a traditional drink after work. We used to ignore such expenses, but cutting them is a sure way to save 10-15% of income.

But it's important not to overdo it. If you exclude all the “pleasures”, life will instantly lose its taste.

Therefore, analyze which habit gives you more pleasure, and save on the rest. For example, instead of takeaway coffee, you can buy a thermo mug and brew the drink yourself.

Less often take food in deliveries and takeaways

At the peak of popularity in big cities are ready-made breakfasts, lunches, lunches and dinners, which will be delivered directly to your home or office. Their advantage is clear: personal time is not spent on cooking, and for the food itself you do not need to go to a cafe or store. But if you calculate the costs, it turns out that deliveries “eat up” up to 15% of the income of those who use them. It turns out to be expensive, because in addition to products, services include cooking and transport costs in the cost.

And it is better to refuse deliveries for environmental reasons.Together with the food, you are delivered a disposable container made of plastic every time. Hot dishes are wrapped in foil, which is not recyclable.

Buy groceries and cook yourself

Semi-finished products are evil. Even if cutlets in local cooking look cute and seem cheap, there is zero real benefit from them. Firstly, the cost of finished food is many times higher than the products used for its preparation. Second, the quality is questionable. For example, in minced meat, which is used for store cutlets, up to 50% of the weight is bread and eggs. A good piece of pork or chicken is more profitable to buy, and there are more benefits.

Therefore, the main advice to those who save the family budget is to buy all the products yourself. But go to the store only full. It is known that hungry people spend 10-15% more. And if you get out for provisions with a shopping list, then spending on food will be minimal.

Other

Radio, cable and landline phone. Check to see if you're still paying for radio, cable, and landline phones you don't use. In the case of the latter, you can choose a time-based tariff instead of an unlimited one, so as not to turn it off completely.

Antenna. You can turn off the collective antenna. For example, if you have satellite or you watch TV via the Internet. By refusing to watch TV shows "with the whole house", you can save about 50-100 rubles. ($2-3) per month.

Payment without commissions. Pay utility bills using Internet banking or terminals that do not charge commission.

Recalculation. In case of absence from the apartment for more than five calendar days in a row, a Russian citizen may demand a recalculation of the fee for the following utilities: water, gas (if there are no meters), sewerage, garbage collection and elevator.Not subject to "revision" fees for: heating and maintenance. Of course, your absence must be documented by submitting the relevant documents to the accounting department of your HOA or housing cooperative.

Checking charges. If you have any doubts about the correctness of utility bills, you must contact your Criminal Code and attach a written application. After that, the applicant must provide a clear and comprehensive answer. The application can be sent by mail or e-mail.

Record an accident. In the event of any accident, according to the law, we are entitled to compensation, that is, a refund for services not provided or services of inadequate quality. In order to receive compensation, violations must be recorded.

Additional Tips

Motivation to save

Try to save a fixed amount from your salary - for example, 5-10%. Set a goal: to save up a certain amount by the end of the year to buy a car, vacation, or educate children. So you will learn not only to save, but also to save, distributing already 90% of your income.

It is good practice to calculate the time spent on a particular product. Calculate the cost of your labor per hour. And then calculate the time you need to devote to work to buy an extra blouse or a pack of cigarettes.

Reduce spending on those items that account for most of the income. It is in these expenses that problems and unnecessary purchases are hidden.

Don't skimp on this

- Do not save on fresh vegetables and fruits. Ditch cigarettes, chips, and beer in favor of an extra pound of apples or carrots. With proper nutrition, the health of the body is maintained - and this is saving on medicines.

- Don't buy really cheap clothes.It is better to buy it more expensive or find a good discount, because. a quality item will last longer.

- On books. Books help to relax and develop, and it is better to give up going to the movies and buy a book. And new knowledge helps to find new sources of income.

Goal setting

Ways to motivate savings:

- Set aside money each month for a specific purpose. For example, for a trip, buying a car, etc.

- Calculate the cost of an hour of your working time: divide the salary by the number of hours worked. Find out how much you need to work to buy jeans or another smartphone case.

- Use special applications to control expenses. They will clearly show how much money is being wasted.

- Analyze what the family budget is spent on. Try to give up unnecessary and unnecessary expenses within a month. Most likely, the result will be pleasant.

Eco life hacks for home and life

Natural resources need to be protected and here are a couple of simple tips that can help with this:

Why, one small light bulb is on, it consumes little! Seriously?

Unplug appliances from the outlet. It seems that the turned off appliances do not consume electricity, but this is not so. Imagine how many such devices in the world that consume a little bit. What if there are a million? A million multiplied by a little - is it a lot or a little?  For those who are too lazy to pull the plugs out of sockets every time, it is worth buying a surge protector with a switch, which, in addition to saving electricity, also protects devices from noise and current surges, extending the life of the equipment. Useful and environmentally friendly.

For those who are too lazy to pull the plugs out of sockets every time, it is worth buying a surge protector with a switch, which, in addition to saving electricity, also protects devices from noise and current surges, extending the life of the equipment. Useful and environmentally friendly.

And the communal service will become cheaper, and you will help nature! How?

Everyone knows about turning off the water while brushing your teeth. But do you know that by arranging water meters in a conspicuous place, you can significantly reduce the overall water consumption? Yes, this method sounds strange, but it really works (the British even tested it in a focus group), because when we see upward changes in the numbers on the counter, we will subconsciously try to consume less. We advise you to additionally install aerators, they will help to reduce water consumption by 2 times. Aerator - a special nozzle on the faucet, which breaks the flow of water into many small ones, while saturating it with air: the pressure of the water remains the same, but the water itself becomes softer and cleaner. The throughput of the tap is on average 15 liters of water per minute, and when installing an aerator, consumption is reduced by more than 50%. Save water = save your money.

I fried the fish and covered the stove! How to wash, if not chemistry?

Do not use chemicals cleaning products at home. Excellent analogues are ammonia, soda and vinegar. Get creative, for example, by replacing synthetic dish sponges with loofah washcloths.

It's incredibly hot right now! Order not to buy water in the summer?

Buy a reusable water bottle or thermo mug. You can save on buying water on the streets, and in some establishments you can even get a discount when buying a drink with your own cup. Please note that it is better to take a refillable bottle made of polypropylene (“5” in a triangle) or low density polyethylene (“2” in the triangle), and if there is no marking on the product at all, then it is better to refrain from such a purchase.

Well, I can not do without the package! How do I put weekly purchases in a shopping bag?

If you can’t immediately refuse plastic bags completely and are used to shopping rarely, but aptly and string bags are not an option, then get a few pieces that you will constantly use and take them with you to the market or to the store. When you are offered to pack the goods in another bag, politely refuse.

As of June 1, 2019, partial or complete plastic bags have been banned in 65 countries. Ukraine is also on this list, but with the note “The ban is planned in Lviv in 2025.” The city authorities of Lviv have approved a program to phase out polyethylene and plastic packaging by 2025.

Share, don't buy

We don't need as many things as we buy. Get a minimum, the rest can be rented in special services or borrowed from friends. If you don’t go to flea markets, second-hand stores or commissaries, try to reduce the number of things you buy, extend their lifespan with careful use, and take broken equipment for repair instead of a garbage dump. Use carsharing or public transport instead of a private car.

Look for promotions, discounts and cashback

It is worth dwelling on discounts in more detail. Shops today are fighting for the buyer, so any means are used to attract him - the liquidation of stale goods, promotions in honor of the holidays, seasonal discounts and black Fridays. You can save a lot on such events: sellers discount from 5 up to 90% of the cost goods, depending on the specifics of the store.

But the main thing that advanced buyers save on is cashback, or a refund of part of the money for a purchase. You should not be afraid of this option: companies offer cashback for the same reasons as discounts.But for us, this is a real way to make money, and in two ways:

By the way, it’s convenient to look for plastic with cashback. We offer a large catalog: you can choose what kind of cashback you want to receive - classic, when "real money" is returned, or a bonus program.

Buy only what you need

Buying the necessary means competently prioritizing (we discussed this in detail above). Here are a few more tips to keep you from wasting your money:

Cooperate with other people

Joint purchase sites are now popular. This is when people cooperate and order a wholesale batch of goods. Benefit - in a discount (separately, each participant will pay more for a unit of goods). With acquaintances, you can buy things from abroad in order to pay less for delivery. Another life hack is to create a common account in an online store with friends and colleagues. When purchases are made frequently and for large amounts, the account accumulates reputation and receives a discount. This benefits all participants.

You can cooperate with strangers not only for shopping. In big cities, carpooling or carsharing is popular today - car sharing, when people find fellow travelers through an online service. This saves money on fuel, pollutes the environment less.

Conclusion

With reasonable savings in the family budget, you need to clearly define the goal and understand which purchases are mandatory and which ones you can refuse. It is necessary to take a break from the daily routine, however, you do not need to go to the resort for this. Residents of big cities have forgotten that there are pleasant and inexpensive pleasures: hiking, field trips, walks in the park or picnics by the river.

To start saving the family budget, first you need to involve all family members in this process. Keep a notepad to keep track of your expenses. Analyzing spending, you can see that a significant part of the salary is spent on all sorts of little things and unnecessary purchases. Having abandoned such expenses and started saving money, we can say with confidence that the family budget is used wisely.